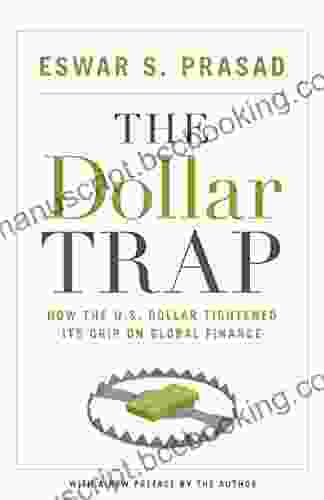

How the Dollar Tightened Its Grip on Global Finance

The US dollar is the world's reserve currency. This means that it is the most widely held and traded currency in the world. It is also the currency that is most often used for international transactions. This gives the US a significant advantage in the global economy.

4.2 out of 5

| Language | : | English |

| File size | : | 8855 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 423 pages |

There are several reasons why the dollar has become the world's reserve currency. One reason is that the US has been the world's largest economy for most of the 20th century. This has made the dollar a safe and stable currency to hold. Another reason is that the US has a strong military, which has helped to protect the dollar's value.

The dominance of the dollar has had a number of consequences for the US and the rest of the world. For the US, the dollar's dominance has allowed it to borrow money at low interest rates. This has helped to fuel economic growth in the US. However, the dollar's dominance has also led to a number of problems for the US. One problem is that it has made the US economy more vulnerable to global economic shocks. Another problem is that it has led to a decline in US manufacturing, as companies have moved their production overseas to take advantage of lower wages.

For the rest of the world, the dollar's dominance has had both positive and negative consequences. On the positive side, the dollar's dominance has made it easier for countries to trade with each other. It has also made it easier for countries to access capital. On the negative side, the dollar's dominance has made it more difficult for countries to pursue independent economic policies. It has also led to a number of financial crises in developing countries.

The dominance of the dollar is a complex issue with a long history. It is a topic that has been the subject of much debate and controversy. However, there is no doubt that the dollar's dominance has had a significant impact on the global economy.

The Historical Context

The origins of the dollar's dominance can be traced back to the 19th century. At that time, the UK was the world's leading economic power. The pound sterling was the world's reserve currency.

However, after World War II, the US emerged as the world's leading economic power. The dollar replaced the pound sterling as the world's reserve currency.

There were a number of factors that contributed to the dollar's rise to dominance. One factor was the US's strong economy. Another factor was the US's military strength. A third factor was the US's role in the Bretton Woods system.

The Bretton Woods system was a system of international economic rules that was established after World War II. The system was designed to promote economic stability and growth. It pegged the value of the dollar to gold. This made the dollar a safe and stable currency to hold.

The Bretton Woods system collapsed in the 1970s. However, the dollar continued to be the world's reserve currency. This was due to the US's strong economy and military strength.

The Economic Consequences of Dollar Dominance

The dollar's dominance has had a number of economic consequences for the US and the rest of the world.

For the US, the dollar's dominance has allowed it to borrow money at low interest rates. This has helped to fuel economic growth in the US. However, the dollar's dominance has also led to a number of problems for the US. One problem is that it has made the US economy more vulnerable to global economic shocks. Another problem is that it has led to a decline in US manufacturing, as companies have moved their production overseas to take advantage of lower wages.

For the rest of the world, the dollar's dominance has had both positive and negative consequences. On the positive side, the dollar's dominance has made it easier for countries to trade with each other. It has also made it easier for countries to access capital. On the negative side, the dollar's dominance has made it more difficult for countries to pursue independent economic policies. It has also led to a number of financial crises in developing countries.

The Political Consequences of Dollar Dominance

The dollar's dominance has also had a number of political consequences. One consequence is that it has given the US a significant amount of power over the global economy. This power has been used to promote US interests and values. For example, the US has used its power to impose sanctions on countries that it does not approve of.

Another consequence of the dollar's dominance is that it has led to a decline in the power of other currencies. This has given the US a disproportionate amount of influence in international financial institutions, such as the International Monetary Fund and the World Bank.

The political consequences of the dollar's dominance are complex and far-reaching. They have had a significant impact on the global political landscape.

The Future of Dollar Dominance

The future of dollar dominance is uncertain. There are a number of factors that could challenge the dollar's dominance, such as the rise of other currencies, such as the euro and the Chinese yuan. However, the dollar is likely to remain the world's reserve currency for the foreseeable future.

The dollar's dominance is a complex issue with a long history. It is a topic that has been the subject of much debate and controversy. However, there is no doubt that the dollar's dominance has had a significant impact on the global economy and politics.

4.2 out of 5

| Language | : | English |

| File size | : | 8855 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 423 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Euan Sinclair

Euan Sinclair Esther Derby

Esther Derby Felix Bachmann

Felix Bachmann Julian Armfield

Julian Armfield Issa Rae

Issa Rae Esraa Ghazo

Esraa Ghazo Firefighter Now

Firefighter Now Karen Cheung

Karen Cheung Kim Masters

Kim Masters Jeffrey Goldberg

Jeffrey Goldberg Gary May

Gary May Melissa Leapman

Melissa Leapman Farrah Rochon

Farrah Rochon Hugh Leach

Hugh Leach Federico Vinciolo

Federico Vinciolo Shannon Sovndal

Shannon Sovndal Pat Patterson

Pat Patterson Jerry Lynch

Jerry Lynch Filipe Vilicic

Filipe Vilicic Yani Alfonso

Yani Alfonso

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Tennessee WilliamsComplete French Grammar Workbook For Adult Beginners: Unleash Your French...

Tennessee WilliamsComplete French Grammar Workbook For Adult Beginners: Unleash Your French...

Federico García LorcaUnveiling the Enchanting World of Emerilia: A Journey into "This Is Our Land"...

Federico García LorcaUnveiling the Enchanting World of Emerilia: A Journey into "This Is Our Land"...

Pablo NerudaUnlock Your Health and Fitness Transformation: Discover the Breakthrough Week...

Pablo NerudaUnlock Your Health and Fitness Transformation: Discover the Breakthrough Week... Harry HayesFollow ·7.3k

Harry HayesFollow ·7.3k Ira CoxFollow ·12.2k

Ira CoxFollow ·12.2k Deacon BellFollow ·3.9k

Deacon BellFollow ·3.9k Fernando PessoaFollow ·13.2k

Fernando PessoaFollow ·13.2k Francisco CoxFollow ·6.6k

Francisco CoxFollow ·6.6k Camden MitchellFollow ·9.7k

Camden MitchellFollow ·9.7k Jayson PowellFollow ·7.1k

Jayson PowellFollow ·7.1k Roland HayesFollow ·13k

Roland HayesFollow ·13k

W.H. Auden

W.H. AudenStep into a World of Thrilling Deception: Don Blink by...

Unveiling the Masterpiece of Suspense:...

Jaylen Mitchell

Jaylen MitchellUnleash Your Creativity with "This Easy Origami": A...

: Embark on an Enchanting Voyage into the...

Vladimir Nabokov

Vladimir NabokovEmpowering Home Births: A Comprehensive Guide for Fathers...

An In-Depth Exploration of Paternal...

Juan Rulfo

Juan RulfoThe Maya Exodus: Indigenous Struggle for Citizenship in...

The Maya Exodus: Indigenous Struggle for...

Julio Ramón Ribeyro

Julio Ramón RibeyroKana Made Easy: Dive into Japanese the Fun and Effortless...

Unveiling the Secrets...

4.2 out of 5

| Language | : | English |

| File size | : | 8855 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 423 pages |